Future Advisors Conference (FAC)

Financial Planning Challenge 2026

The FAC provides students of Wealth Management / Financial Planning programs with a chance to participate in the following financial planning challenge.

Eligibility

-

Participants: Open to undergraduate and combined degree students.

-

Team Composition: Teams must consist of 2-4 members from the same institution.

-

Multiple teams from the same institution are allowed to participate.

-

Faculty Advisor: Each team should have a faculty advisor for guidance and support. Multiple teams can have the same advisor.

-

Industry Advisor: Industry advisor feedback, coaching, and mentoring are encouraged as the ultimate goal for the challenge is to provide students with an opportunity for learning and growth.

Timeline

- Preliminary Submission (Virtual due December 8th, 2025): Submission of a written financial plan based on a provided case study via virtual submission

- On the front-page list student names, faculty advisor, industry advisor(s), and school affiliation. Do not include any other team-identifying information following the first page.

- Email submission to helene.hale@warrington.ufl.edu by December 8th, 2025, 11:59PM with subject “FAC Financial Planning Challenge submission”.

- Results will be announced by December 12th.

- Presentations (In-person on Wed, Jan 21st): Selected teams will present their financial plan to a panel of judges on the in-person platform.

- Winners Announced: Close of the FAC on Thu, Jan 22nd

Deliverables

- Written Financial Plan: A comprehensive document that includes analysis, recommendations, and a clear action plan for the client.

- Client Profile & Goals

- Financial Analysis

- Recommendations (e.g., investment strategies, risk management)

- Implementation Plan

- Appendices (supporting calculations, graphs, etc.)

- Presentation (if qualified for the in-person round), is to be done as if you are presenting to the client, summarizing the key aspects of the financial plan. Any delivery format is allowed; creativity and effectiveness of the presentation style will be a part of evaluation criteria. This may include a PowerPoint presentation, walking through financial planning software reports or simulation. Judges may ask hypothetical “what-if” questions.

- Duration: 10-12 minute presentation followed by an extensive Q&A session with judges.

Evaluation Criteria

- Technical Accuracy (30%): Correctness and thoroughness of financial analysis, calculations, and recommendations.

- Client-Centric Approach (25%): The extent to which the plan aligns with the client’s goals, values, and risk tolerance.

- Creativity & Innovation (15%): Unique and effective strategies or solutions proposed in the financial plan.

- Presentation (20%): Clarity, organization, and persuasiveness of the presentation, including the ability to answer judges’ questions.

- Professionalism (10%): Overall professionalism in the written plan, presentation, and interaction with judges.

Financial Planning Software

Participants are encouraged to utilize financial planning software, such as MoneyGuidePro, eMoney, or similar tools, to enhance the accuracy and professionalism of their financial plans. Incorporating software-generated analyses and visual aids can strengthen your recommendations and presentations. Students needing access to software, contact FAC organizers.

Artificial Intelligence

Participants are free to leverage artificial intelligence tools and resources to enhance their financial analysis, forecasting, and strategy development. However, all AI-generated content must be original, and used in a manner that supports ethical decision-making and demonstrates a strong understanding of financial principles. The final submission should reflect the student’s own work, with AI serving as a tool to complement their knowledge and creativity.

Awards

- Winning Team: Each member of the winning team will receive CFP prep from – The Dalton Review® ($1,595 value / person)

- Additional prizes may be supplemented by sponsors.

FAC – Financial Planning Challenge 2026

Developed by

Gillen Manos (AllGen Financial)

Aaron Bert CFP® (Certified Financial Group, Inc)

Kevin Caldwell CFP® (Golden Road Advisors)

Meet your new clients, Beth (03/25/95) and Donald (08/27/97) Gorrie. Beth was born in Cedar Key, Florida and left to attend UF when she was 18, which is where she met Donald. Beth and Donald have been married for eight years and have two children, Ava (08/03/18) and Bradley (05/06/21). Their youngest child, Susan, is expected to be born in January of 2026. They live in Tampa, Florida where Donald was born and raised. Beth and Donald had a bad experience with another financial planning firm, Sunshine Capital and Asset Management, in Tampa, and are wary about the financial industry. They heard about you through a friend and are giving you a chance because of that.

Donald owns a small HVAC business from which he takes $120,000 per year in distributions. Donald has one partner, Greg, with whom he started the business seven years ago as a general partnership (They each own 50%). The two have five employees. Recently, Donald’s company finished a job for a local business park and cleared a one-time profit of $125,000. Donald and Greg each took $50,000 and split the rest amongst their employees as a bonus. However, even if they land similar jobs in future, Donald does not want to take any more bonuses. They barely finished the most recent job on time, and Donald and Greg decided to take the next five years and invest in the business as much as possible. They want to establish a proper succession plan, a retirement plan for employees (until now Donald has just been maxing out his IRA), and finish up some deferred maintenance on their equipment.

Beth has been a full-time homemaker and mother since Ava was born in 2018. She occasionally helps Donald with bookkeeping, but she spends most of her time homeschooling their children. Bradley, now four years old, was diagnosed at age two with mild spastic hemiplegic cerebral palsy, likely caused by a lack of oxygen during birth. While cognitively strong and sociable, Bradley has limited motor function on his right side. He walks independently but wears an orthotic brace and continues to receive physical therapy several times per week. Beth and Donald are committed to giving Bradley the fullest possible life but worry about the long-term costs of therapy, assistive equipment, and possibly specialized private schooling. His needs aren’t overwhelming, but they are persistent, and the Gorries feel unprepared for the financial and legal aspects of planning for his future. They’ve heard of programs they might be able to use to fund private schooling for their children but aren’t sure where to start. They are happy to keep homeschooling until at least middle school, so they’d like to take the time to research what private school options exist in Tampa and what they might cost.

The Gorries also aren’t committed to sending their children to college. They see it as a possibility but also want to be prepared if their kids want to attend trade school, get a technical education, or start their own business. They are willing to start saving so that they can help their children get started after high school, but they don’t want to limit their options too much.

Beth’s grandmother passed away six years ago and left her and Donald her childhood home in Cedar Key, along with a $150,000 mortgage on the property. It was worth about $175,000 at the time. The home is structurally sound but cosmetically shabby and outdated. The mortgage has about 20 years remaining with a monthly payment of $950 at a 4.5% interest rate. Currently, the property is generating just enough income to cover expenses and is roughly breaking even each year. Donald has spoken to a real estate agent in the area and determined that they could sell the home as is for $210,000. Alternatively, they could renovate the home for $35,000 in order to boost the sale price to approximately $315,000. If they wished to keep the home, either for the income or for sentimental reasons, they could invest an extra $10,000 to convert it into a short-term rental. They estimate that this renovation would increase the revenue from the house and allow for an annual profit of $8,000.

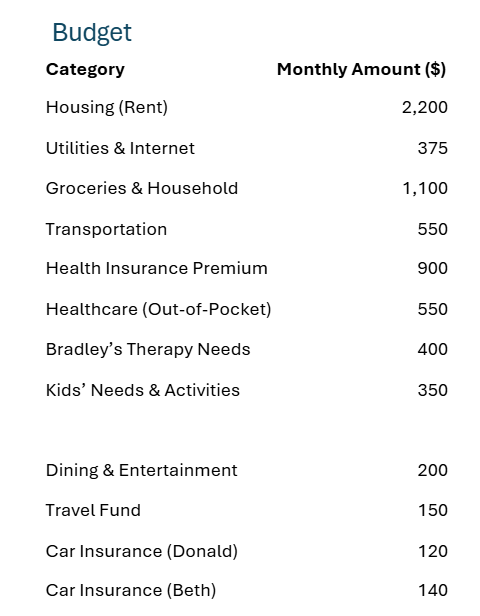

The Gorries’ all-in annual living expenses for 2024 were approximately $85,000. They prepared a summary of income and expenses for you to review. Donald and Beth don’t have any life insurance and getting some is one of their top priorities. Donald knows that the family couldn’t function if either parent were to pass away, but so far life insurance just hasn’t been something he wants to think about. He’s heard of all kinds of different life insurance products, even ones that might help his kids save for college, but he’s really not sure what to pick and is worried about getting ripped off. Donald provides health insurance for the family through a small group plan he set up through his business, with the company covering half the $1,800 monthly premium. The plan is HSA-eligible and covers major expenses, but they still pay several thousand dollars out of pocket each year. They don’t have any money accumulated in their HSA right now since they used it for Bradley’s birth and therapy expenses. They’d love to lower those costs, if possible, but it’s not a top priority.

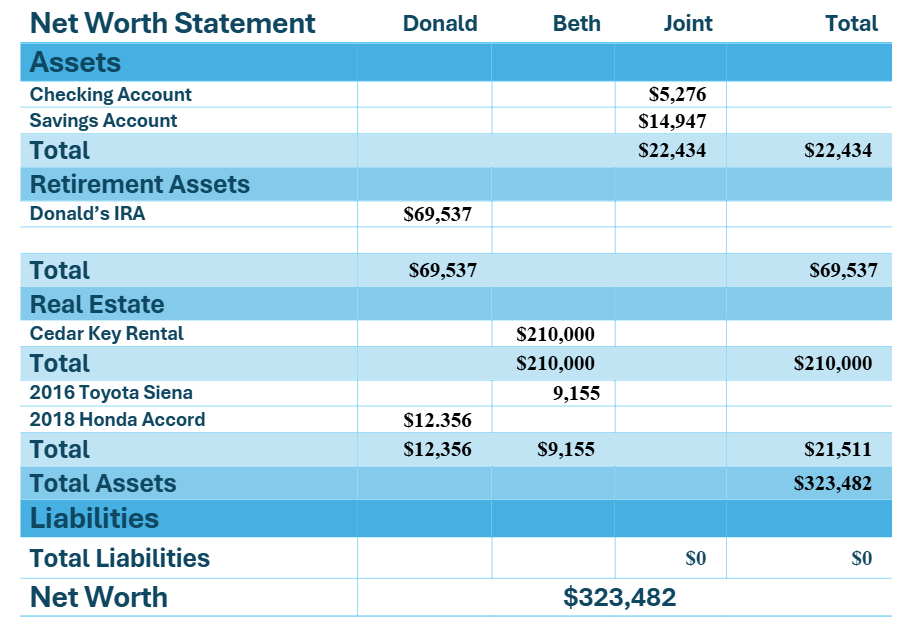

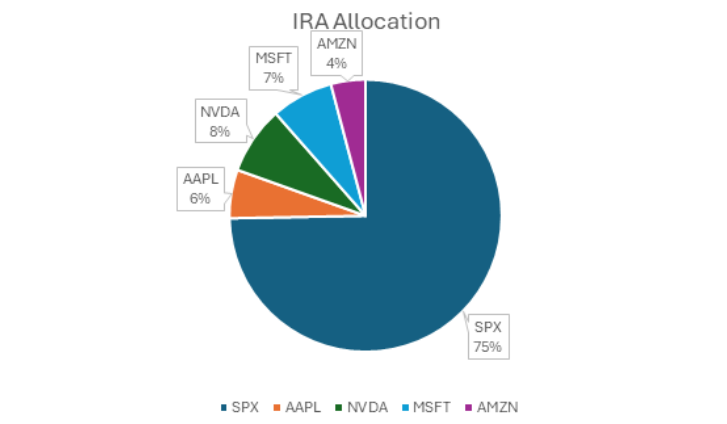

Donald’s IRA currently has a balance of $70,000, with most of the balance invested in S&P 500 no-load index funds and the rest in some stocks he found interesting. Donald knows he needs to invest for his family’s future, but never really understood the markets. He doesn’t want to invest in anything too complex going forward, or pay high fees, but he is willing to take advice on expanding outside of just the S&P. Donald and Beth have a moderate risk tolerance. He plans to work until at least 62, and maybe later depending on how much work he is still doing in the business. Beth has no plans to go back to work until after their kids are grown up, although she is willing to help out around the business part-time if needed. Neither of them has much faith in Social Security. Beth is also worried about their estate plan. They had the basic documents done the year after they were married but haven’t updated things since they had kids.

Donald and Beth both grew up loving the outdoors and want to instill that same love in their children. In a few years, they would like to start taking trips every year or two to the National Parks. Beth in particular wants to visit the Channel Islands in California and go kayaking in the sea caves.

Donald and Beth have rented for their entire marriage so far. They get along very well with their landlord and don’t anticipate having to move anytime soon. Their rent goes up every few years, but stays mostly in line with inflation. They are very cautious about buying a home before they are ready, and don’t want to stretch their budget. They do eventually want to buy and would prefer a 15-year fixed rate mortgage that doesn’t exceed 30% of their income. Because they do not typically borrow money, they want some advice on getting a manually underwritten mortgage.

Beth drives a 2016 Toyota Sienna and Donald has a 2018 Honda Accord. Beth’s Sienna has 80,000 miles on it, while Donald’s Accord has 60,000 miles. They are happy with their cars but would like to be able to pay cash whenever it is eventually time to upgrade.

Insurance

- Health Insurance: High-Deductible HSA Plan: $900/month

- Car Insurance (Donald): $120/month, $1,000 deductible, 100/100/300 coverage

- Car Insurance (Beth): $140/month, $1,000 deductible, 100/100/300 coverage

- Donald receives a 70% disability insurance policy paid fully as a employee benefit